350

Our house is on fire. The European Central Bank must rebuild it for

PEOPLE NOT

POLLUTERS

#JustRecovery #Rebuild4People

Right now, in the midst of the Covid-19 crisis, care – for patients, for workers, for each other – must take center stage.

But decisions about what comes next are already being made. We have a choice: to build back better, or to further fuel inequity, injustice and climate destruction.

Share on Facebook || Share on Twitter || Share via Whatsapp

The European Central Bank’s emergency response must ensure that people and the planet, not polluters, are at the heart of a just recovery in Europe and beyond. Instead of handouts for fossil fuels we must invest in an economy that cares for people and the planet.

We ask the European Central Bank to:

DO NO HARM: The Bank must ensure that money meant to support the European economy amidst the Covid-19 crisis does not go to companies who are driving the climate crisis, including the fossil fuel industry, banks who invest heavily in coal, oil and gas, or other high-polluting sectors.

BUILD BACK BETTER: The Bank needs to intervene to help shape a more resilient, sustainable and fair European economy, and provide the leadership and funds needed for a Just Recovery based on a real Green New Deal.

Why are we targeting the European Central Bank?

Stop funding climate criminals!

In partnership with:

Sign to ask the European Central Bank to stop funding fossil fuel companies 👇

Recently, our friends at Reclaim Finance published a vital new report which proves that the European Central Bank (ECB) is providing funds to some of the world’s biggest fossil fuel companies. [1] That means that public money – our money – is being used to fuel climate change and destroy lives.

That’s right: climate criminals like Shell and Total are getting money from the European Central Bank's emergency Covid-19 response fund. That money was supposed to help European people and economies recover after the pandemic, fund green, sustainable, decent jobs and public services. Instead, millions of euros are being used by the ECB to fuel the climate crisis by funding some of the heaviest CO2 emitters on the planet. [2]

In times of economic crisis like right now, the European Central Bank has a critical role to play. So far, it's been acting in emergency mode. Now its leadership must be made to see that they can't solve one crisis by fuelling another.

The ECB’s first priority must be to make sure that their efforts to address the economic crisis do not inadvertently make the climate crisis worse. That means making sure that no money goes to the fossil fuel industry, or other high-polluting sectors, or to banks which finance climate-wrecking industries.

Secondly, the European Central Bank must take a leading role in helping Europe to build back better, by providing the funds needed for a real Green New Deal – creating decent jobs, investing in essential public services, and driving a rapid shift to green, affordable and sustainable energy for all. [3]

[1] Reclaim Finance

[2] The Guardian

[3] People not Polluters campaign

Join the campaign Want to get involved as a group or organisation? get in touch!

How the European Central Bank is the key to a just recovery

The European Central Bank (ECB for short) sits at the heart of Europe’s financial system. It manages how much money makes the rounds in our economies, sets interest rates and oversees commercial banks across all the countries that use the euro currency.

In a time of crisis, it is responsible for stopping the whole system from collapsing. The choices the ECB and its President, Christine Lagarde, make right now, as they put in place emergency measures to keep the economy going through the Covid-19 crisis, and prepare recovery plans for when lockdowns end, will shape Europe and impact our everyday lives for years to come.

With a clear direction and commitment to a Just Recovery, the urgent measures needed to protect jobs and companies in the short-term could also help boost a real Green New Deal, and our chances for a sustainable and resilient future on a living planet.

The last time the ECB was in the spotlight like this was after the financial crash of 2008, when the Bank took unprecedented steps to keep the financial sector afloat and prevent mass bankruptcies. This worked in the short-term, but most of the money ended up going to big banks and multinational corporations instead of small businesses and households.

It was a tragic missed opportunity. Instead of making sure that these huge cash injections were used to prevent future crises, eliminate poverty, strengthen our communities and tackle climate change, the money from the ECB mostly ended up in the pockets of the super-rich. Shareholders saw their fortunes skyrocket in the years after the financial crash, while the rest of us paid the price with a decade of harsh austerity. Inequality increased, public services were stretched to the limit, and carbon emissions continued to rise.

The ECB is now taking centre-stage again, as Europe responds to the COVID-19 crisis. Alongside the public health response, governments and public institutions like the ECB are taking extraordinary steps to try to minimise the economic impacts of the crisis on individuals, businesses and society. One of the most important steps they’ve taken is to start injecting more than €750 billion into the European economy over the next few months. The ECB does this mainly by buying bonds from governments and companies.

With this money, states can invest in public services like hospitals or schools even when their citizens can’t work and pay taxes. Banks can give low interest loans which companies can use to cover their losses. And corporations can pay worker’s salaries – or, if no restrictions are imposed, buy back their own shares and create more wealth for a handful of rich shareholders.

And that’s why it’s so important that we learn the lessons from the past, and make sure that this time we don’t try to return to ‘business as usual’ – which, frankly, wasn’t working very well for the majority of people anyway – and instead invest in the kind of future that we actually want.

The ECB’s first priority must be to make sure that their efforts to address the economic crisis do not inadvertently make the climate crisis worse. That means making sure that no money goes to the fossil fuel industry, or other high-polluting sectors, or to banks which finance climate-wrecking industries.

Secondly, the European Central Bank has the opportunity to play a pivotal role in helping Europe to build back better, by providing the funds needed for a real Green New Deal – creating decent jobs, investing in essential public services, and driving a rapid shift to affordable and sustainable energy for all.

Questions & Answers

If you’re asking yourself now “what is this ECB?” or “why now?” – you’re not the only one. Have a read:

News & blogs

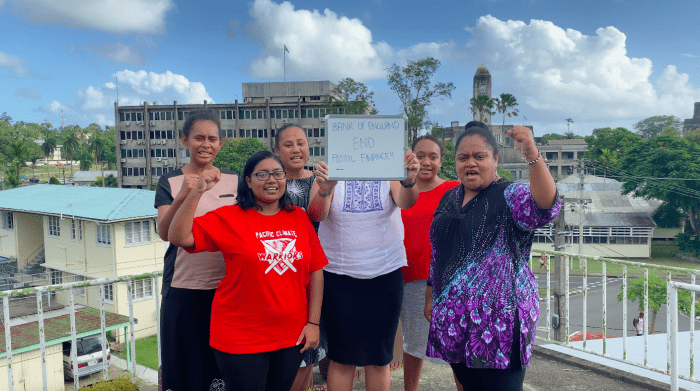

Why are we talking about the Bank of England?

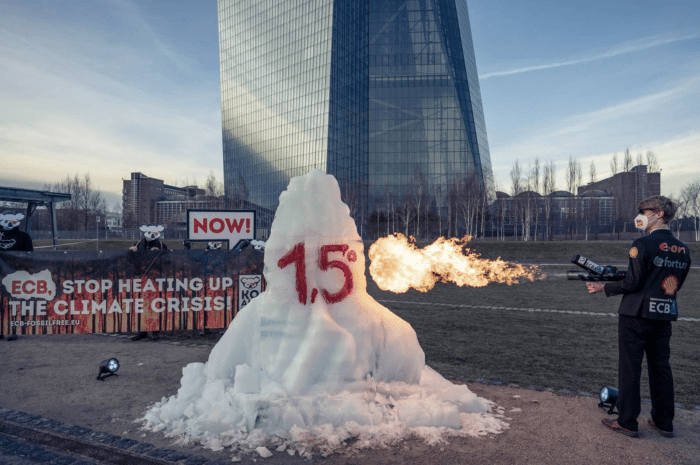

Flamethrowers and glaciers… at the European Central Bank

In 2021 we’ll keep going after the money